Reading view

Plane Carrying Colombian Politicians Crashes in Area Contested by Rebels

RCN Poll Reveals Cepeda’s 30% Ceiling, Right’s Path to Consolidation

Colombia’s presidential race has entered poll season with a revealing snapshot from Noticias RCN and Spanish firm GAD3 that points to an election defined less by early frontrunners than by who can consolidate votes after March’s inter-party consultations.

At first glance, Historic Pact senator Iván Cepeda appears comfortably ahead. The RCN poll places him at 30% voting intention — well above far-right independent Abelardo de la Espriella (22%) and miles ahead of the scattered field trailing behind in single digits.

But a deeper reading of the numbers suggests Cepeda’s lead may already be capped.

The 30% figure aligns almost perfectly with President Gustavo Petro’s loyal electoral base, which has consistently hovered between 28% and 32% since his rise to national prominence. In other words, Cepeda appears to have consolidated petrismo rather than expanded beyond it. The poll reinforces this ceiling: 5% of respondents favor a blank vote, 11% say they would vote for none of the candidates, and 14% remain undecided — a combined 30% still outside the Petro orbit and unlikely to gravitate toward Cepeda.

Further down the list, potential left-leaning or independent figures barely register: Sergio Fajardo, Aníbal Gaviria, Juan Daniel Oviedo, Roy Barreras and Camilo Romero each sit around 1%. Even Claudia López and Germán Vargas Lleras score negligible fractions. The fragmentation benefits Cepeda for now, but it also masks the absence of new voters entering his camp.

By contrast, the Right’s apparent weakness hides a powerful consolidation opportunity.

The Gran Consulta por Colombia, on March 8, shows Paloma Valencia leading the consultation vote with 23%. Yet the poll also reveals that the rest of the consultation slate collectively commands nearly 20%: Juan Manuel Galán (8%), Vicky Dávila (8%), Juan Carlos Pinzón (6%), Juan Daniel Oviedo (4%), Aníbal Gaviria (3%), Enrique Peñalosa (2%), David Luna (1%) and Mauricio Cárdenas (1%).

This bloc is electorally decisive because it represents Colombia’s ideological center — liberal technocrats, urban moderates and business-friendly reformists who reject Petro’s economic direction but resist extreme rhetoric. Valencia’s political résumé, Senate visibility and party machinery position her as the most viable leader to absorb that vote once the consultation narrows the field.

If she consolidates those nearly 20 points, her support would leap toward — or beyond — 40%, instantly surpassing Cepeda’s apparent plateau.

De la Espriella’s 22% underscores the volatility on the Right but also its fragility. His voters overlap heavily with Valencia’s base and are expected to migrate toward a unified conservative candidacy. Even Uribe has hinted that such unity is inevitable in a runoff; the RCN poll suggests it could happen much earlier under electoral pressure.

Yet the poll’s most intriguing subplot lies within the Left’s own consultation, where Roy Barreras emerges as a latent threat to Cepeda despite low headline numbers.

In the Frente Amplio consultation, Cepeda commands 34%, but the striking figure is the 44% who say they would vote for none. Barreras registers 4%, and Camilo Romero 3%, revealing a progressive electorate deeply unconvinced by the current slate.

Barreras’ political positioning explains why that matters. Though aligned with Petro’s government, his ideological lineage is closer to former President Juan Manuel Santos — pragmatic, transactional and coalition-oriented. Unlike Cepeda, Barreras is seen as someone capable of negotiating with centrists and conservatives alike. He represents continuity without ideological rigidity.

If Barreras manages to capture even part of that dissatisfied 44%, Cepeda’s narrow base could erode quickly. The RCN poll already shows Cepeda strong only where the Left is unified and stagnant where broader voters are involved.

Second-round simulations deepen the warning. Cepeda defeats De la Espriella 40% to 32%, but those numbers again reflect Petro’s core plus soft undecideds. Against Paloma Valencia he drops to 43% versus her 20% — a gap that would narrow dramatically once Valencia inherits the consultation bloc. More telling still, Cepeda’s numbers barely move across matchups, reinforcing the perception of a fixed ceiling.

Colombia’s presidential arithmetic is therefore shifting beneath the surface.

Cepeda leads because the field is divided. Valencia stands to surge because her side is about to unify. Barreras lurks as the only left-leaning figure capable of fracturing Cepeda’s ideological monopoly and attracting voters beyond Petro’s loyalists.

While headlines focus on Cepeda versus De la Espriella, the RCN poll suggests the real race may ultimately emerge after March 8 — between Paloma Valencia consolidating a broad anti-Petro coalition and Roy Barreras positioning himself as the Left’s only candidate with cross-spectrum appeal.

In Colombia’s elections, momentum follows math. And the math is just beginning to move.

Colombia’s 23.7% Minimum Wage Hike, Stirs Inflation and Informality Fears

Colombian President Gustavo Petro on Monday decreed a 23.7% increase in the country’s minimum wage for 2026, the largest real rise in at least two decades, bypassing negotiations with unions and business groups and sparking warnings from economists, bankers and employers over inflation, job losses and rising informality.

The decree lifts the monthly minimum wage to 1.75 million pesos (U.S$470), or close to 2 million pesos including transport subsidies, and will apply to roughly 2.5 million workers when it takes effect next year. Petro said the measure aims to reduce inequality and move Colombia toward a “living minimum wage” that allows workers to “live better.”

But business associations, financial analysts and opposition lawmakers said the scale of the increase — far above inflation and productivity trends — risks destabilising the labour market and the broader economy.

According to calculations based on official data, with inflation expected to close 2025 at around 5.3% and labour productivity growth estimated at 0.9%, a technically grounded adjustment would have been close to 6.2%. The gap between that benchmark and the decreed hike exceeds 17 percentage points, the largest deviation on record.

Informality and job losses

Colombia’s minimum wage plays an outsized role in the economy, serving not only as the legal wage floor but also as a reference for pensions, social security contributions and public-sector pay.

Banking association Asobancaria warned that increases far above productivity can generate unintended effects. Citing data from the national statistics agency DANE, the group noted that 49% of employed Colombians — about 11.4 million people — earn less than the minimum wage, mostly in the informal economy, while only 10% earn exactly the minimum wage. Former director of DANE and economist Juan Daniel Oviedo believes that an increase that only benefits one-out-of-ten workers will stump job creation. “A minimum wage of 2 million pesos will make us move like turtles when it comes to creating formal jobs — something we need to structurally address poverty in Colombia.”

Retail association FENALCO described the decision as “populist” and said the talks had been a “charade.” Its president, Jaime Alberto Cabal, said the process ignored technical, economic and productivity variables and would hit small businesses hardest.

Lawmakers also raised concerns about the impact on independent workers and contractors in the agricultural sectors, especially hired-help on coffee planations. Carlos Fernando Motoa, a senator from the opposition Cambio Radical party, said the decision would push vulnerable workers out of the formal system.

“The unintended effects of this improvised handling of the minimum wage will end up hitting independent workers’ pockets,” Motoa said. “Many will be forced to choose between eating or paying for health and pension contributions.”

Economists warned that micro, small and medium-sized enterprises — which account for the majority of employment — may respond by cutting staff, reducing hours or shifting workers into informal arrangements to cope with higher payroll and social security costs.

Inflation and rates at risk

Analysts also cautioned that the wage hike could reignite inflation, complicating the central bank’s easing cycle. Central bank economists have forecast 2026 inflation at 3.6%, down from 5.1% expected in 2025, but several analysts said those projections may now need revising.

In an interview with Reuters, David Cubides, chief economist at Banco de Occidente, called the increase “absolutely unsustainable,” warning it would affect government payrolls, pension liabilities and the informal labour market.

“Inflation forecasts will have to be revised,” Cubides said, adding that interest rates could rise again in the medium term as a result.

The impact is amplified by Colombia’s ongoing reduction in the legal workweek. From July 2026, the standard workweek will fall to 42 hours, meaning the hourly minimum wage will rise by roughly 28.5%, further increasing labour costs.

The decree comes six months before the presidential election on May 31, 2026, and is viewed by critics of Colombia’s first leftist administration as an electoral gamble aimed at shoring up support for the ruling coalition’s candidate, Senator Iván Cepeda.

Opposition senator Esteban Quintero, from the Democratic Center party, warned that Colombia risked repeating the mistakes of other Latin American countries that pursued aggressive wage policies.

“Careful, Colombia. We cannot repeat the history of our neighbours,” Quintero said. “Populism is celebrated at first — and later the costs become unbearable.”

Former finance minister and presidential hopeful Mauricio Cárdenas said the decision would inevitably lead to layoffs, particularly in small businesses already operating on thin margins, and described the policy as “economic populism” whose costs would materialise after the election cycle.

“The employer ends up saying, ‘I can’t sustain this payroll,’” Cárdenas said. “People are laid off, and many end up working for less than the minimum wage. In the end, nothing is achieved.”

Liberal Party senator Mauricio Gómez Amín said the increase risked becoming a political banner rather than a technical policy tool.

“Without technical backing, a 23% increase translates into inflation, bankruptcies and fewer job opportunities,” Gómez Amín said. “Economic populism always sends the bill later.”

While supporters argue the measure will boost purchasing power at the start of 2026, analysts cautioned that the short-term gains could be offset by higher prices, job losses and a further expansion of Colombia’s informal economy — already one of the largest in Latin America.

Hard-Left Candidate Iván Cepeda Leads Poll for Colombia’s 2026 Election

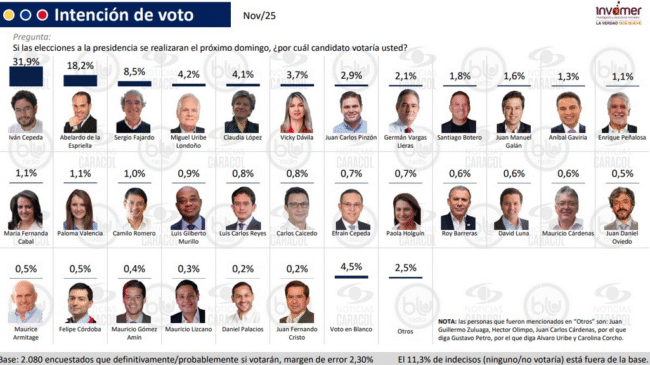

Senator Iván Cepeda of the ruling Historic Pact coalition has emerged as the early front-runner in Colombia’s 2026 presidential race, according to a nationwide Invamer poll released Sunday by Caracol TV and Blu Radio. The survey – the first major measurement since the lifting of Colombia’s recent polling restrictions – places the left-wing candidate at 31.9% of voting intention, six months ahead of the first round.

The results position Cepeda well ahead of candidate Abelardo de la Espriella of Defensores de la Patria, who received 18.2%, and independent centrist Sergio Fajardo, who registered 8.5%. Miguel Uribe Londoño, running for the leadership of President Álvaro Uribe Vélez’s Centro Democrático party, follows with 4.2%. Uribe Londoño is the father of Senator Miguel Uribe Turbay, victim of an assassination attempt on June 7, and who died two months later at the Santa Fe Hospital in Bogotá.

The findings come amid broad public dissatisfaction with the country’s direction and with the administration of President Gustavo Petro, who leaves office on August 7, 2026. According to the poll, 56% of respondents disapprove of Petro’s administration, while 37% approve. Although disapproval has dipped slightly from previous months, nearly six in ten Colombians remain critical of the government. National sentiment is similarly pessimistic: 59.8% believe Colombia is “on the wrong track,” compared with 34.4% who feel otherwise.

Internal security stands out as the leading concern. Asked whether Petro’s “Total Peace” policy had made them feel safer, 66.2% claim it made them feel more insecure. Nearly 65% believe the initiative is moving in the “wrong direction”, and 73% say the government has lost territorial control to illegal armed groups. Only 20% expressed confidence in the government’s peace and security approach.

The Invamer survey, conducted between November 15 and 27 among 3,800 respondents in 148 municipalities, does not include public reaction to the latest scandal involving alleged infiltration of state institutions by FARC dissidents. The poll has a 1.81% margin of error and a 95% confidence level.

Cepeda’s lead reflects firm support among left-leaning voters and measurable gains among independents and left-leaning centrists. Though only 24% of those polled identified themselves as “left-wing”, the senator’s 31.9% support suggests he is drawing backing among younger voters. He also carries a relatively high rejection rate: 23.9% said they would “never” vote for him.

The survey challenges the perception that Cepeda lacks room to grow beyond the left, even as 50% expressed that they would prefer to vote for a candidate opposed to Petro. Analysts believe the Historic Pact’s decision to hold its internal consultation last month helped consolidate support within the coalition and gave Cepeda a strategic advantage.

Despite his lead, Cepeda could face voter rejection should Petro’s disapproval ratings continue to climb. The candidate’s current negative rating is among the highest of any public figure, and his pro-Petro agenda on security, economy, and U.S relations could push the center closer to the moderate right. Still, the poll indicates Cepeda would win a runoff against De la Espriella with a wide margin, but face a “technical tie” with the mathematician and former Governor of Antioquia.

De la Espriella, meanwhile, has quickly consolidated the anti-Petro vote, emerging as a “dark horse” at the extreme right of the spectrum. Once absent from early electoral projections, the lawyer now surpasses established Centro Democrático politicians – including senators María Fernanda Cabal, Paola Holguín, and Paloma Valencia.

Former defense minister under President Juan Manuel Santos and ex-Ambassador to Washinton, Juan Carlos Pinzón, is in seventh place (2,9%), but these early numbers are likely to increase, given that he maintains a close relationship with three ideological camps (Centro Democrático, La U, Cambio Radical) represented in Presidents Uribe and Juan Manuel Santos, and German Vargás Lleras.

Even though the poll found that 63% of eligible voters know who De la Espriella is, there is room for continued growth for the five candidates who marked above 2% in the poll, among them, Vargas Lleras in fifth place (2.1%).

The centrist bloc, historically influential in Colombian politics, appears fragmented. Fajardo, once considered a reliable alternative to both left and right, no longer polls in double digits. While he maintains a lower rejection rate than most rivals and doubles the numbers of former Bogotá mayor Claudia López (4.1%), analysts say the proliferation of centrist candidates could dilute Fajardo’s base. Combined, these candidates would outpace De la Espriella’s support, but the numbers suggest this does not translate into a cohesive electoral force.

Foreign policy is also shaping voter priorities. A large majority – 78% – said maintaining strong relations with the United States is essential for the next administration. Respondents widely rejected Petro’s decision to use a megaphone in New York to urge U.S. soldiers not to follow orders from former President Donald Trump; 78% disapproved of the act, even though half of respondents hold an unfavorable view of Trump.

President Petro reacted to the poll on social media, framing the electoral landscape as a struggle between entrenched elites and what he described as a “powerful people” seeking to reclaim the state. Referring implicitly to Uribe and Fajardo, the president said Colombia must reject “mafioso elites” and work toward a “free and educated” society.

The Centro Democrático announced it will conduct an internal vote among more than 4,000 active party members to select two candidates for a March 2026 primary. The contenders are senators Cabal, Holguín, and Valencia, and Miguel Uribe Londoño.

With six months until the first round on May 31, 2026, the Invamer poll highlights a polarized electorate, deep concerns over security and corruption, and an early advantage for the ruling coalition’s candidate — with substantial uncertainty and new political alignments spearheaded by former presidents, especially Álvaro Uribe.